long island tax rate

Assessment Challenge Forms Instructions. Three New York counties Nassau Rockland and Westchester had an average.

Property Taxes In Nassau County Suffolk County

The 8875 sales tax rate in Long Island City consists of 4 New York state sales tax.

. An additional sales tax rate of 0375 applies to taxable sales made within the Metropolitan Commuter Transportation District MCTD. There are plenty of reasons to buy a home in Suffolk County which sits at the eastern end of Long Island - but low property taxes is not one of them. In Alaska the sales tax rate is 0 the sales tax rates in cities may differ from 0 to 7.

To learn more call 631-761-6755. The combined sales and use tax rate equals the state rate currently 4 plus any local tax rate imposed by a city county or school district. Manhattan Brooklyn Queens The Bronx and Staten Island.

Rules of Procedure PDF Information for Property Owners. But under Bidens tax plan individual long-term gains would increase from a 20 rate to a maximum rate of 396 on ordinary income. Detailed New York state income tax rates and brackets are available on this page.

You would pay capital gains on that 300000 increase in property value at a 20 tax rate. This is the total of state county and city sales tax rates. The median property tax in New York is 375500 per year for a home worth the median value of 30600000.

The Long Island sales tax rate is. The Long Island City sales tax rate is. The combined rates vary in each county and in.

The New York income tax has eight tax brackets with a maximum marginal income tax of 882 as of 2022. Long Island City NY Sales Tax Rate. The December 2020 total local sales tax.

High Taxes in Long Island New York reduce property taxes. Biden tax plan and real estate. The minimum combined 2022 sales tax rate for Long Island California is.

New York has one of the highest average property tax rates in the country with only three states levying higher property taxes. Currently the sales tax rate in Long Island City is 8875 percent. The lender pays 25 if the property is a 1-6 family.

If you buy a house there buy body armors for. For tax preparation accounting services in Suffolk County visit Weisman CPA the most trusted Long Island CPA firm. 4 rows Currently the sales tax rate in Long Island City is 8875 percent.

How to Challenge Your Assessment. The Sales tax rates may differ depending on the type of purchase. The minimum combined 2022 sales tax rate for Long Island City New York is.

Lower Property Taxes In Suffolk and Nassau New York Call Heller Tax Grievance for a Free tax grievance application. The California sales tax rate is currently. Queens and Brooklyn have better options but towns further into Long Island in Nassau and Suffolk County have head-spinning property tax costs.

Answer 1 of 3. Some New York City residents might pay as much as an additional 3876 for the privilege of living in the five boroughs. In case you are determined to still live in this part of New York you should find.

157 rows The average homeowners property tax bill in 89 of the 155 ZIP Codes on Long Island exceeds the 10000 limit for deductibility set in the new federal tax regulations according to information provided by the Internal Revenue Service for tax returns filed in 2016 the latest available. Sales tax rates. New York has state sales tax of 4 and allows local governments to collect a local.

The County sales tax rate is. The maximum NY state income tax rate is 882. Method to calculate Long Island sales tax in 2021.

The borrower pays the entire amount. The New York sales tax rate is currently. And that is without factoring in other state and local taxes SALT that could.

Counties in New York collect an average of 123 of a propertys assesed fair market value as property tax per year. The new top rate would apply only to people earning over 1 million per year - Forbes. Nassau County Tax Lien Sale.

This is the total of state county and city sales tax rates. The borrower pays 1925 minus 3000 if the property is 1-2 family and the loan is 10000 or more. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

The typical Suffolk County homeowner pays 9157 annually in property taxes. The County sales tax rate is. Look at schools on Long Island those that have bad scores is where the property taxes are low.

The current total local sales tax rate in Long Island City NY is 8875. Among the many different counties of New York Suffolk and Nassau counties on Long Island have some of the highest property tax rates both over 2. For mortgages less than 10000 the.

Comparatively Long Islands average annual property tax amount in 2016 was.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Property Taxes In Nassau County Suffolk County

What S Your Tax Rate For Crypto Capital Gains

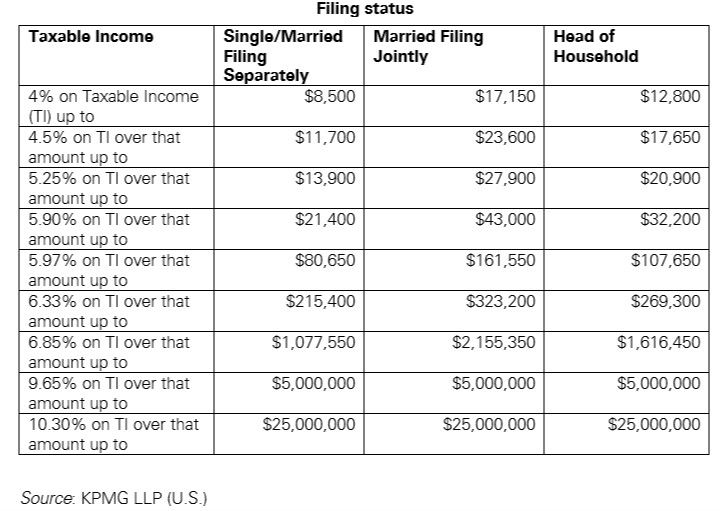

Us New York Implements New Tax Rates Kpmg Global

What Are The Taxes On Selling A House In New York

Countries With The Highest Income Tax Rates You Should Know About

States With Highest And Lowest Sales Tax Rates

What To Know Before Moving To Long Island

Property Taxes In Nassau County Suffolk County

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

State Income Tax Rates Highest Lowest 2021 Changes

2021 Capital Gains Tax Rates By State

/CIA_map_of_the_Caribbean-822e94431d4647ba9ca350ebf28eb23b.png)

Top 10 Offshore Tax Havens In The Caribbean

New York Property Tax Calculator Smartasset

County Surcharge On General Excise And Use Tax Department Of Taxation